About

Contact us

Improve your loss assessment procedures with coaXion

In the insurance industry, even minor details can have a significant impact. coaXion helps insurers by providing valuable data and insights that can be used to improve the loss assessment process, with a platform that allows you to access real-time asset valuation and tracking, allowing for more precise and efficient loss assessments.

ValueWise tracking hardware

Enhanced precision across the loss assessment process with coaXion

In the world of heavy machinery, the value of assets can change due to such factors as equipment usage and market conditions. Traditional valuation methods are often unreliable, as they only provide point-in-time insights that rely on subjective and time-consuming processes. This outdated approach leaves businesses without the guidance to make informed decisions in Australia’s complex civil landscape.

The problem lies in the non-linear depreciation of heavy assets, which can fluctuate based on the type and intensity of usage and which requires a valuation approach that can accommodate the changes in real time. However, current methods use static and linear models that do not provide objective data, resulting in inaccurate representations of an asset's true value.

This is why ValueWise+™ ushers in a new era of asset valuation, offering a dynamic solution grounded in real-time insights that include OEM telematics, market sales insights, and our proprietary MotionTrack™ hardware.

Enhanced precision across the loss assessment process with coaXion

Trust and transparency are fundamental in insurer-client relationships, which is why coaXion aids in minimising errors through data-backed loss assessments, thereby nurturing trust with policyholders. By offering precise valuation insights, coaXion can play a key role in determining accurate compensations and mitigating disputes with areas in which our product can be beneficial, including:

-

Data-driven insights for informed decision-making

Real-time data insights from coaXion can facilitate more accurate and timely evaluations. By analysing a wide array of data points, insurers can comprehensively understand asset conditions during the loss assessment process.

-

Streamlined claims processing

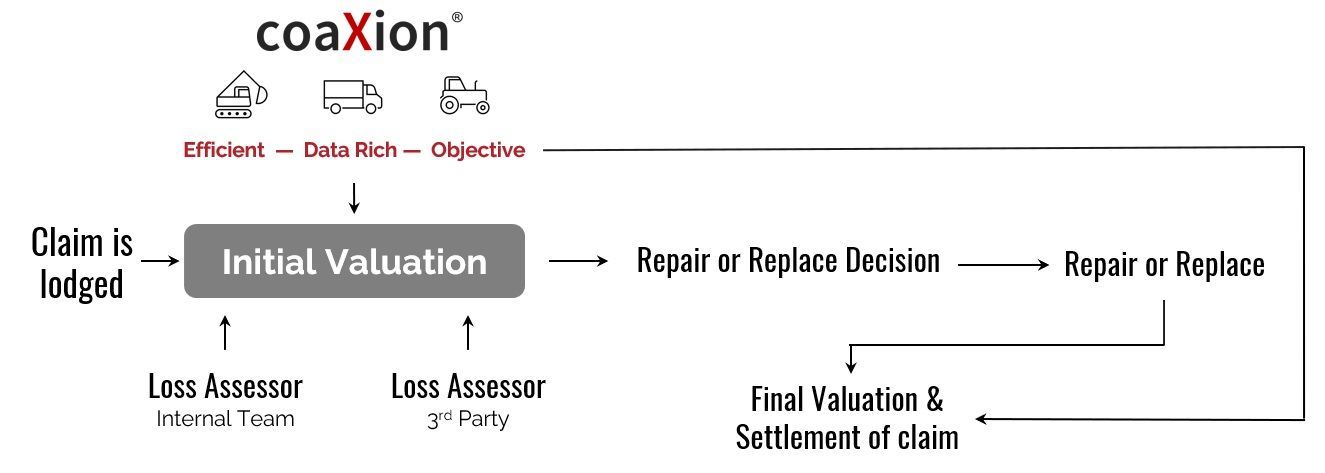

Integrating coaXion's platform makes processing claims much simpler and faster. This leads to a more seamless workflow from loss reporting to claim settlement, enhancing operational efficiency.

-

Fraud mitigation

Utilise intelligent algorithms to detect irregularities and potentially fraudulent activities early in the claims process, helping to safeguard your company's interests and maintain a healthy portfolio.

-

Enhanced customer satisfaction

Create a high customer satisfaction rate while prompting transparency and trust with policyholders by offering quicker and more accurate claim settlements. This can be a strong point of differentiation in a competitive market.

Speak to coaXion about your loss assessment procedure today

Contact a team member today to learn more about our available products and how they can be incorporated into your loss assessment procedures. Simply give us a call or fill out our enquiry form, and we’ll be happy to answer any questions and guide you through the process of getting started with us.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

Jane Faber, New York

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.